Dnaneer-دنانير

Services

- Brand identity

- User experience

- MVP

- Software platform

Location

- SAUDI ARABIA

industry

- Fintech

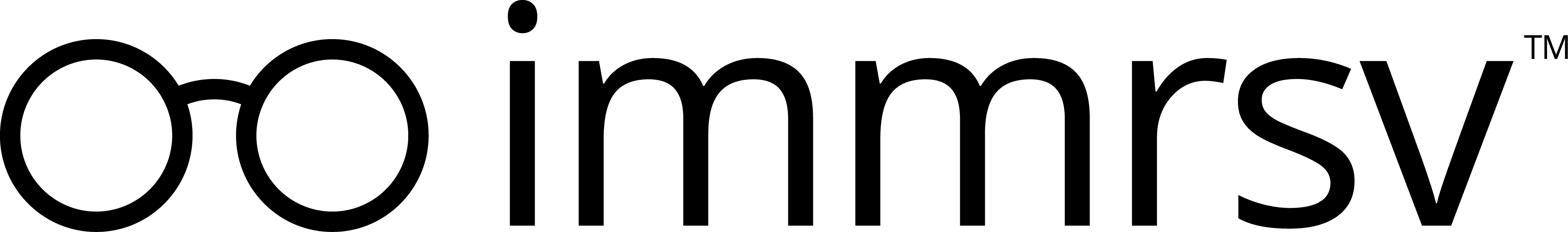

Dnaneer Fintech Platform

Overview

Dnaneer, a fintech startup in Saudi Arabia, set out to revolutionize revenue-based lending by offering businesses flexible financing solutions. However, entering a highly regulated financial market required a strategic partner who understood both the complexities of fintech and the regulatory landscape in Saudi Arabia. That’s where immrsv came in.

Challenges

1. Establishing a strong brand identity in a competitive market.

2. Designing an intuitive user experience that builds trust and simplifies complex lending processes.

3. Developing a functional MVP that aligns with Saudi Central Bank (SAMA) regulations to secure the necessary licensing.

4. Building a robust software platform capable of handling secure transactions and real-time lending operations.

immrsv’s Solutions

1. Strategic Branding & Positioning

We developed a compelling brand strategy that communicated Dnaneer’s mission of empowering businesses through accessible financing. By aligning every aspect of Dnaneer’s identity with the values of trust, transparency, and innovation, we created a brand that resonates deeply with its audience.

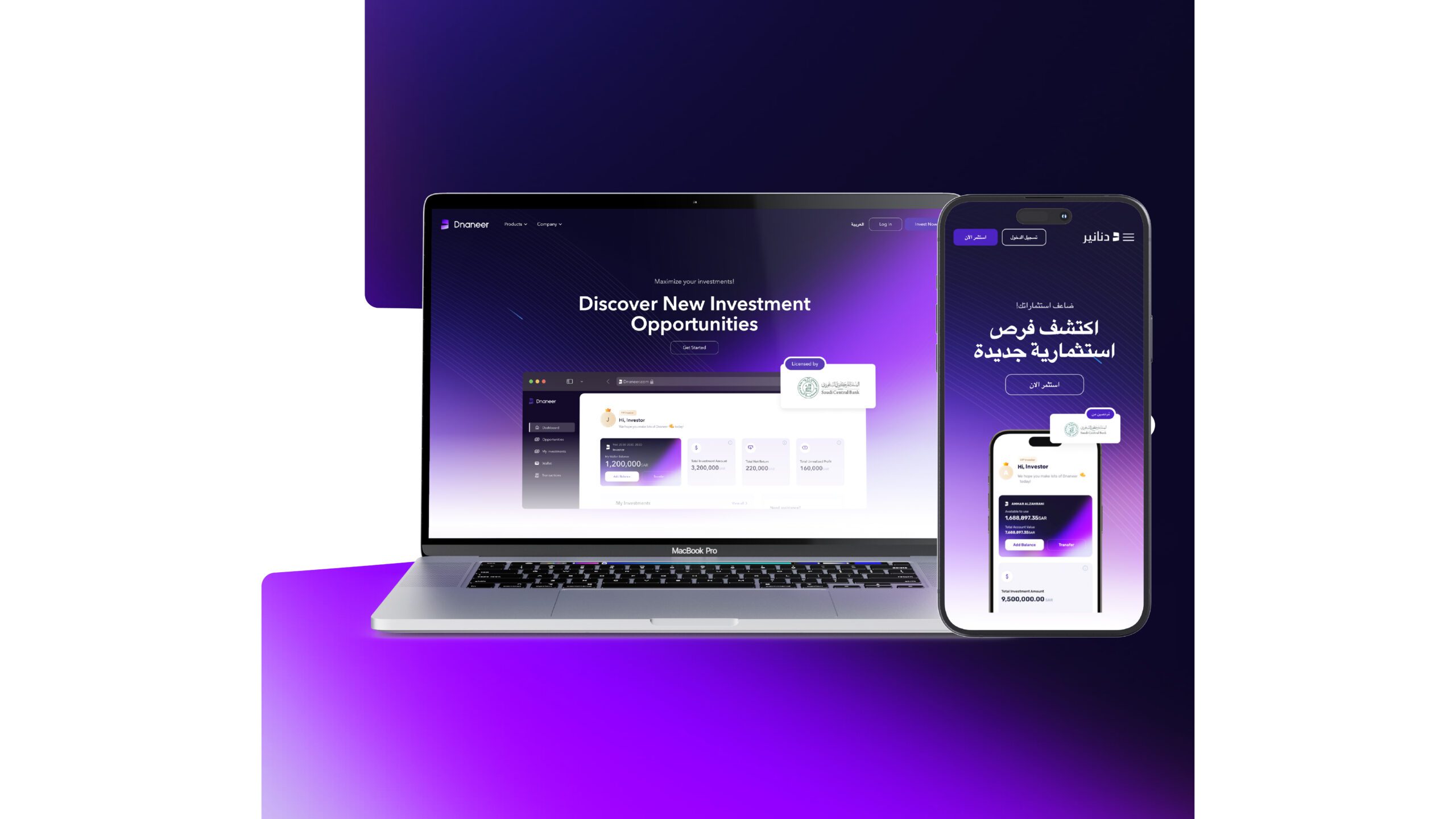

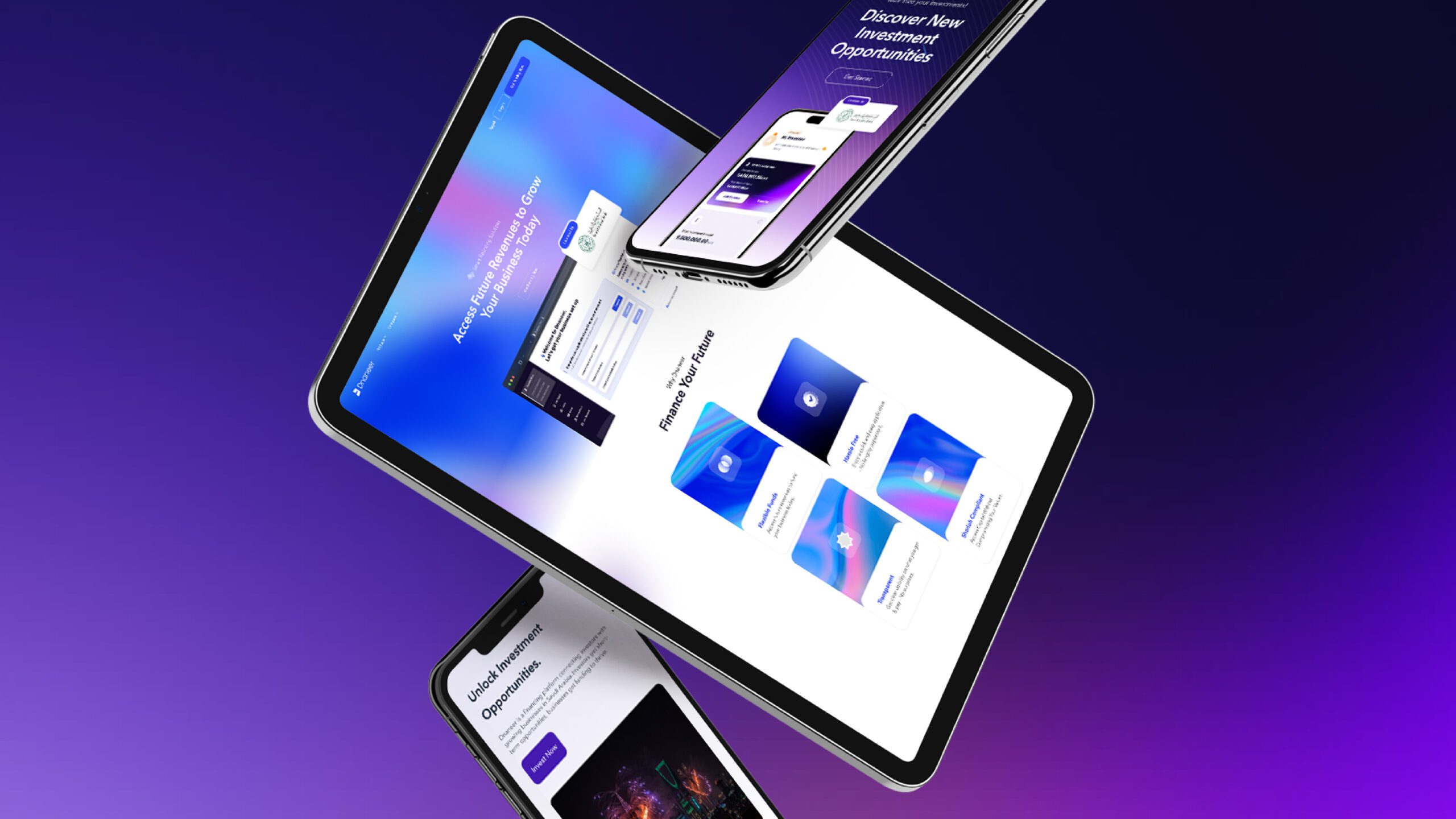

2. Seamless User Experience Design

To differentiate Dnaneer in the market, we designed a user-centric lending platform that simplifies the loan application process. By leveraging intuitive navigation, clear visuals, and user-friendly dashboards, we enhanced the overall experience, making it easier for businesses to access financing.

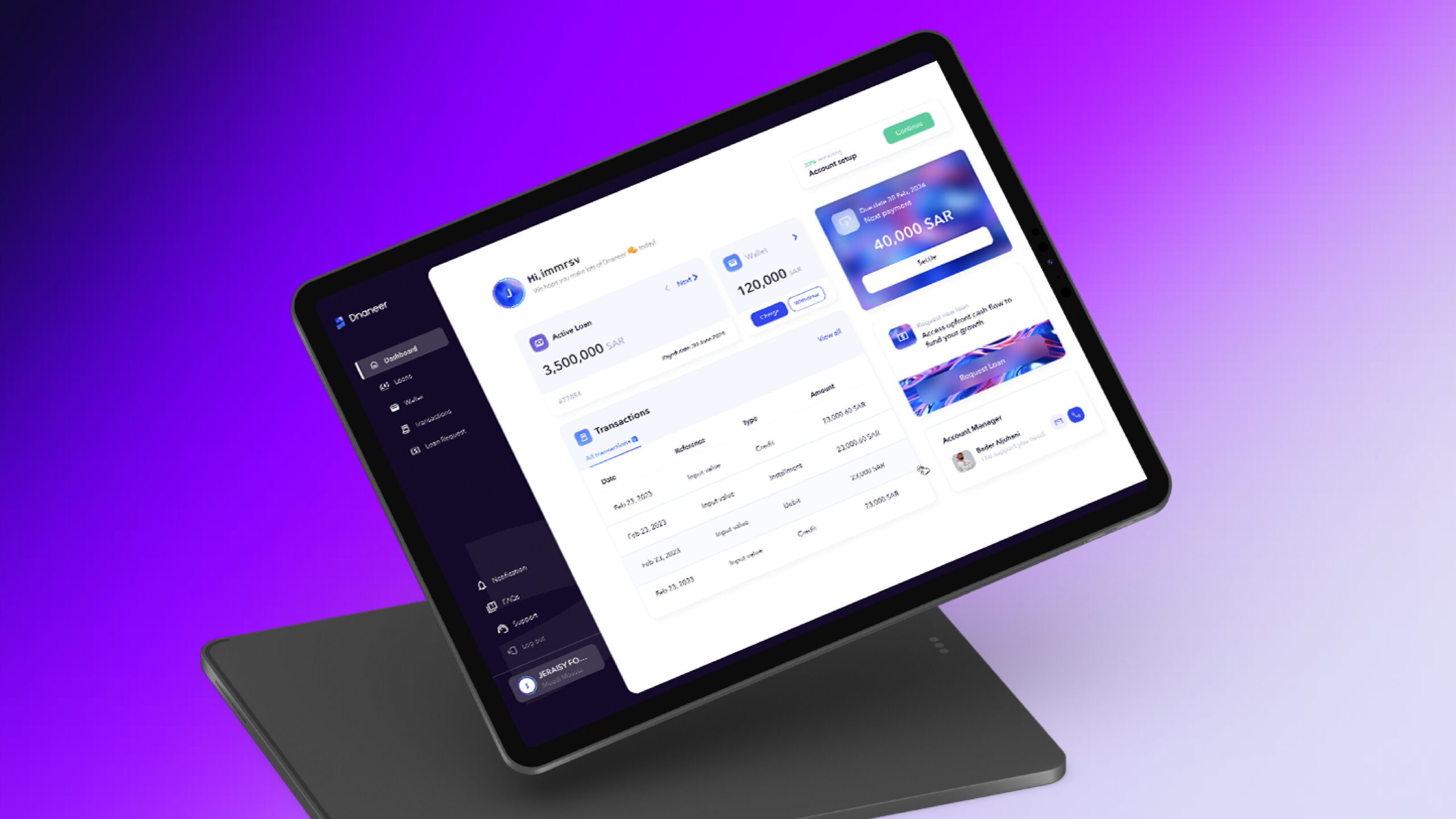

3. MVP Development & Regulatory Compliance

Building a compliant MVP from the ground up was crucial. Our team developed a platform that integrated seamlessly with Saudi regulatory systems like Nafath and LeanTech. The MVP’s agile and modular design allowed Dnaneer to validate its model quickly and secure its lending license.

4. Full-Scale Software Development

Our software engineers built a scalable and secure platform that could handle high transaction volumes while ensuring compliance with SAMA’s stringent standards. The platform supports real-time data analytics, enabling Dnaneer to optimize its lending strategies and drive growth.

Results & Impact

1. Successfully secured SAMA’s lending license, allowing Dnaneer to launch operations with full regulatory backing.

2. Achieved a 45% increase in customer trust and engagement post-rebranding.

3. Delivered a fully functional MVP within four months, accelerating market entry.

4. Enabled Dnaneer to process thousands of loan applications seamlessly, ensuring a 99.9% uptime.

Conclusion

By combining branding, UX design, MVP development, and software expertise, immrsv empowered Dnaneer to disrupt the Saudi fintech landscape. Our comprehensive approach ensured that Dnaneer not only met regulatory requirements but also exceeded market expectations, positioning them as a trusted leader in revenue-based financing.

Let’s work & innovate together

Reach out to our team today, and let’s explore how we can help you design what others can’t. Menu, Footer: